Irs Married Filing Jointly Tax Brackets 2025. New income tax brackets for filing in 2025; The bracket you’re in depends on your filing status:

Understanding how your income falls into different tax brackets can help with tax. For example, just because a married couple files a joint return with $100,000 of taxable income in 2025 and their total taxable income falls within the 22% bracket for.

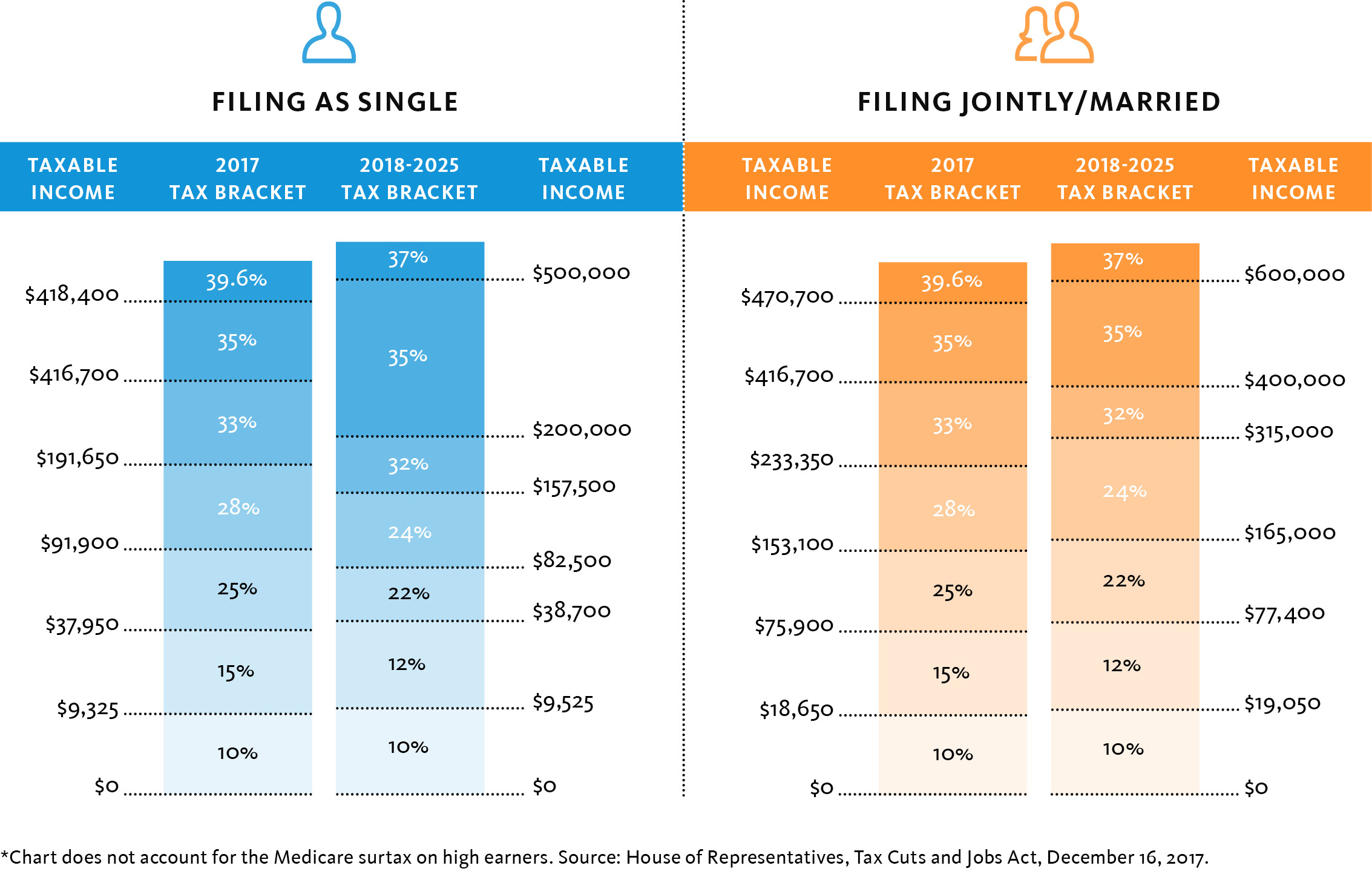

The filing status options are to file as single, married filing jointly, married filing separately, head of household, or qualified surviving spouse.

Irs Tax Brackets 2022 Married Jointly Latest News Update, Here’s how that works for a single person earning $58,000 per year: In a press release, the irs described the 2025 tax year adjustments that will apply to income tax returns filed in 2025.

What are the Different IRS Tax Brackets? Check City, Taxable income and filing status determine which federal tax rates apply to. Single, married filing jointly, married filing separately or head of household.

About Tax Brackets Married Filing Jointly Es Article, The top tax rate for 2025 will remain at 37% for individual single taxpayers with incomes greater than $609,350, or $731,200 for married couples filing jointly. The average income tax rate in 2021 was 14.9 percent.

How to fill out IRS form W4 Married Filing Jointly 2023 YouTube, The top tax rate for 2025 will remain at 37% for individual single taxpayers with incomes greater than $609,350, or $731,200 for married couples filing jointly. The standard deduction for single filers rose to $13,850 for 2023, up $900;

brackets reveal your tax rate as deadline to file 2021 taxes is, Looking ahead to the tax year 2025, the tax brackets are anticipated to be adjusted further to account for inflation and. 35% for incomes over $243,725 ($487,450 for married couples filing jointly) 32% for incomes over $191,950 ($383,900 for married couples filing jointly)

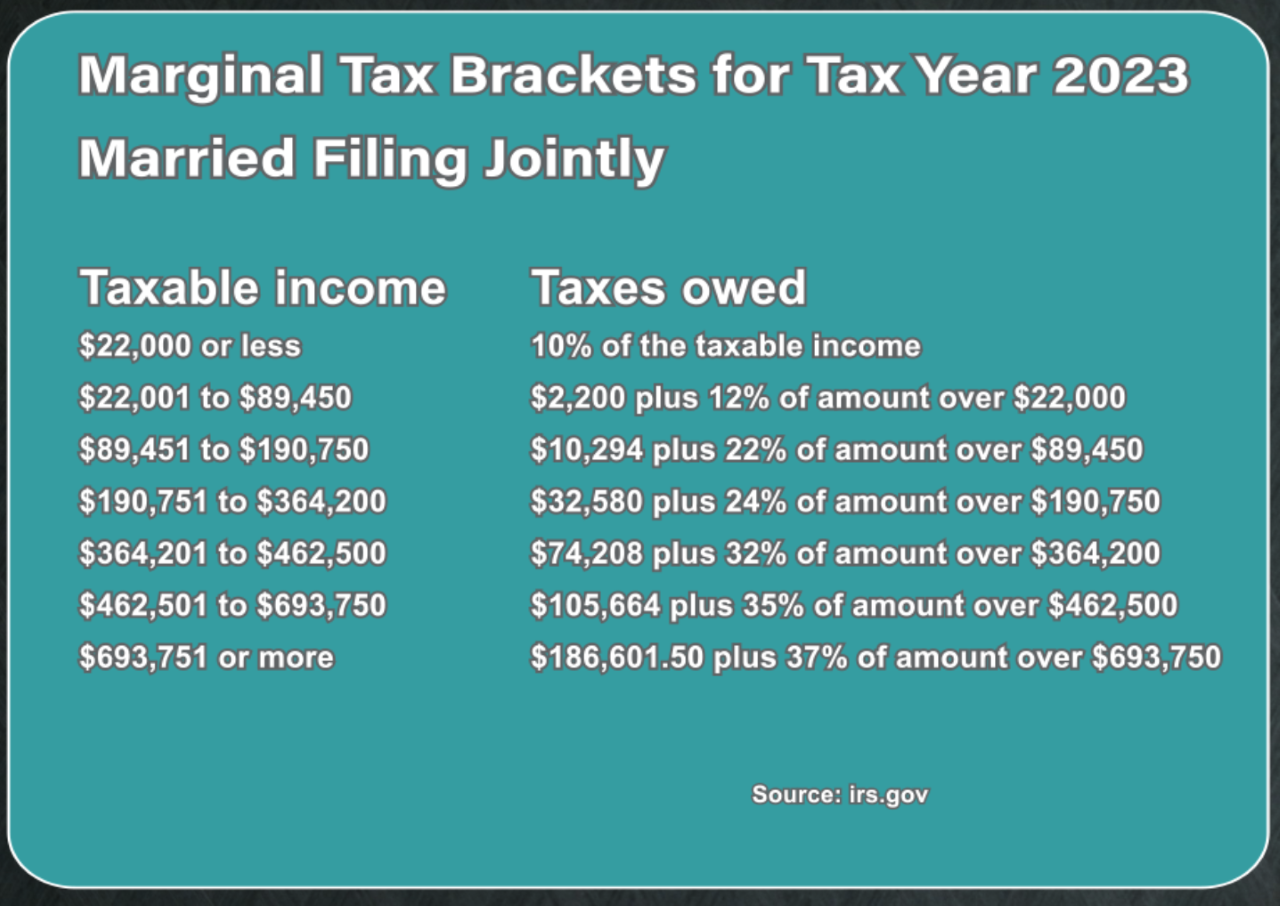

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, For tax year 2023, the standard deduction is $27,700 for married couples filing jointly and $13,850 for single taxpayers and married individuals filing separately. The filing status options are to file as single, married filing jointly, married filing separately, head of household, or qualified surviving spouse.

How to fill out IRS Form W4 Married Filing Jointly 2022 YouTube, Married filing jointly or qualifying surviving spouse. Looking ahead to the tax year 2025, the tax brackets are anticipated to be adjusted further to account for inflation and.

2022 Tax Brackets Irs Married Filing Jointly dfackldu, Looking ahead to the tax year 2025, the tax brackets are anticipated to be adjusted further to account for inflation and. The filing status options are to file as single, married filing jointly, married filing separately, head of household, or qualified surviving spouse.

Tax Brackets 2025 Married Jointly California Myrle Tootsie, At the top of the 1040 tax. For example, single service members with taxable income ranging from $44,726 to $95,375 would be in the 22% tax bracket.

IRS Tax Brackets AND Standard Deductions Increased for 2023, For the 2025 tax year, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

In a press release, the irs described the 2025 tax year adjustments that will apply to income tax returns filed in 2025.